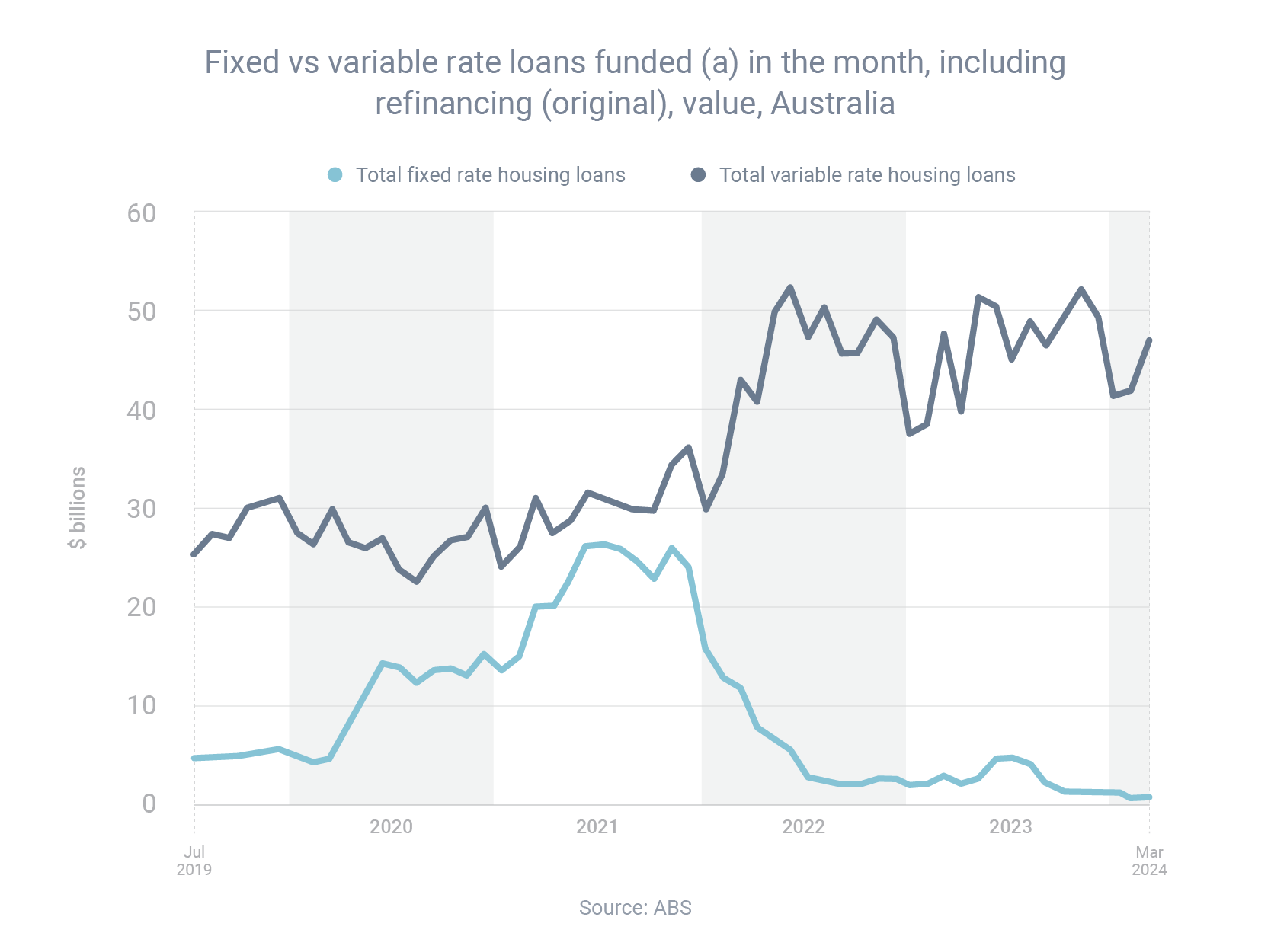

Variable-rate loans scaled to new heights of popularity, as demonstrated by the dramatic shift in borrowing trends. In March 2020, at the start of the pandemic, 13.38% of new borrowers chose fixed-rate loans and 86.62% chose variable. But in March 2024, a staggering low of only 1.40% of new loans were fixed, compared to 98.60% variable. This is based on the report by the Australian Bureau of Statistics.

Variable-rate loans scaled to new heights of popularity with so many borrowers going variable right now because of a widespread belief that interest rates are at or near their peak. This means that variable borrowers would benefit from any future rate cuts. Conversely, in July 2021, borrowers chose fixed-rate loans for 46.02% of loans, while only 53.98% were variable.

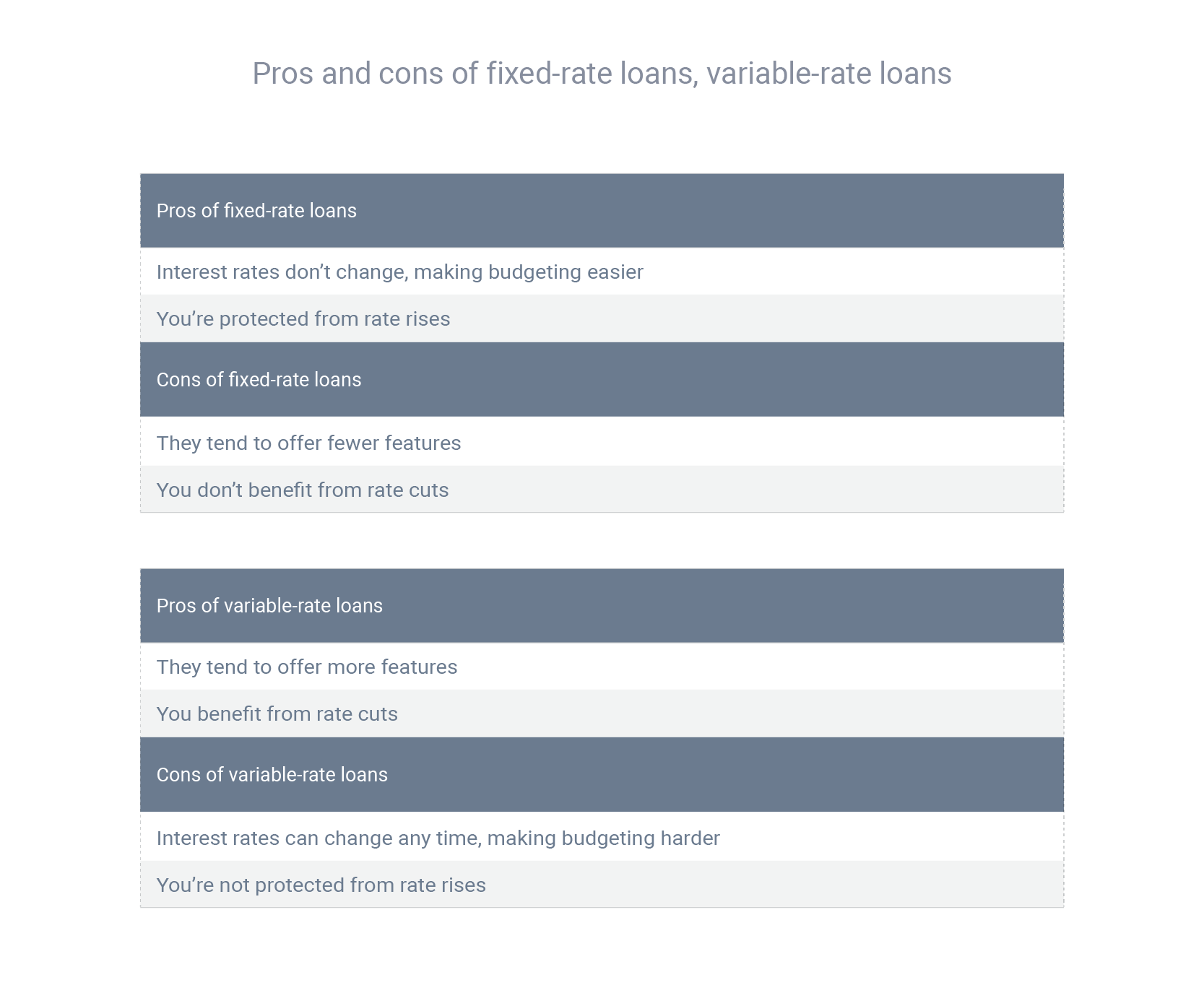

If you’re wondering whether fixed or variable is right for you, here are the main pros and cons of each option:

Making the Right Choice

When deciding between fixed and variable-rate loans, consider your financial situation, risk tolerance, and market expectations:

- Risk Tolerance: If you prefer stability and predictability, a fixed-rate loan might be better. If you’re comfortable with some level of uncertainty and potential fluctuations in payments, a variable-rate loan could be more suitable.

- Market Conditions: Assess the current interest rate environment and economic outlook. If rates are expected to decline, a variable rate might offer savings. Conversely, if rates are projected to rise, locking in a fixed rate could provide security.

- Financial Goals: Consider your long-term financial goals and how the loan fits into your broader financial plan.

Consulting with a financial advisor can also provide personalized insights tailored to your specific circumstances, helping you make an informed decision.

Ready to make a choice? Contact us today to explore your loan options and find the best fit for your needs.