Australia recorded a national vacancy rate of just 1.0% in June, according to SQM Research, which means the rental market is strongly favouring property investors.

Over the past 12 months, the percentage of vacant properties has fallen from 1.7% to 1.0%. As a result, there is now only one vacancy for every 100 rental properties.

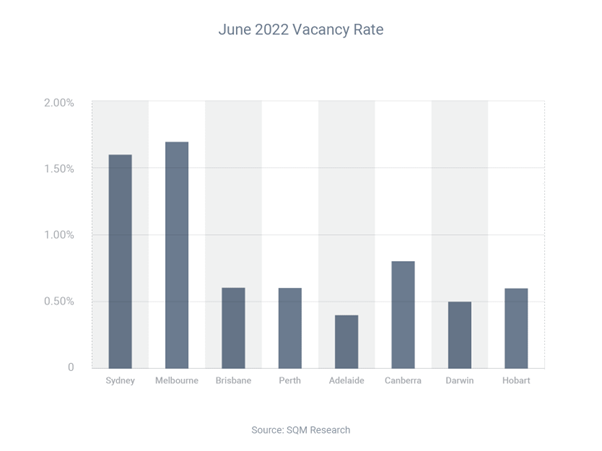

Extraordinarily, as you can see in the chart below, the vacancy rate is even lower in six of the eight capital cities with only Melbourne and Sydney being the outliers. Having said that, even in these cities there are not many rental properties remaining empty for long.

When the vacancy rate is so low, it’s easy for property investors to find quality tenants for their property, because demand is so high and/or supply is limited.

In that kind of landlord’s market, rents tend to rise, because tenants are willing to pay more money to ensure they have somewhere to live. We have also been hearing anecdotally from many of our real estate partners that attendance at rental property openings is extraodinarily high.

At times like this, if you are in a position to do so, it is worth considering getting into the property market and securing a rental property.

If you’d like to buy an investment property, contact Australian Loans Group for an obligation free discussion. While prices are softening in some markets, that can actually be a blessing in disguise, because it means you’ll face less buyer competition. With this comes the potential to pick up a discounted property with a decent rental yield.

If you are thinking about purchasing a rental property, vacancy rates are an important factor to consider as part of your research. If you’d like more information regarding this please contact us, or alternatively take a look at the SQM Research website where you can look up the data for areas across the country.