Property downturn may be over as Australian property prices rose 0.6% in March. According to CoreLogic, property prices rose for the first time in 11 months since April 2022.

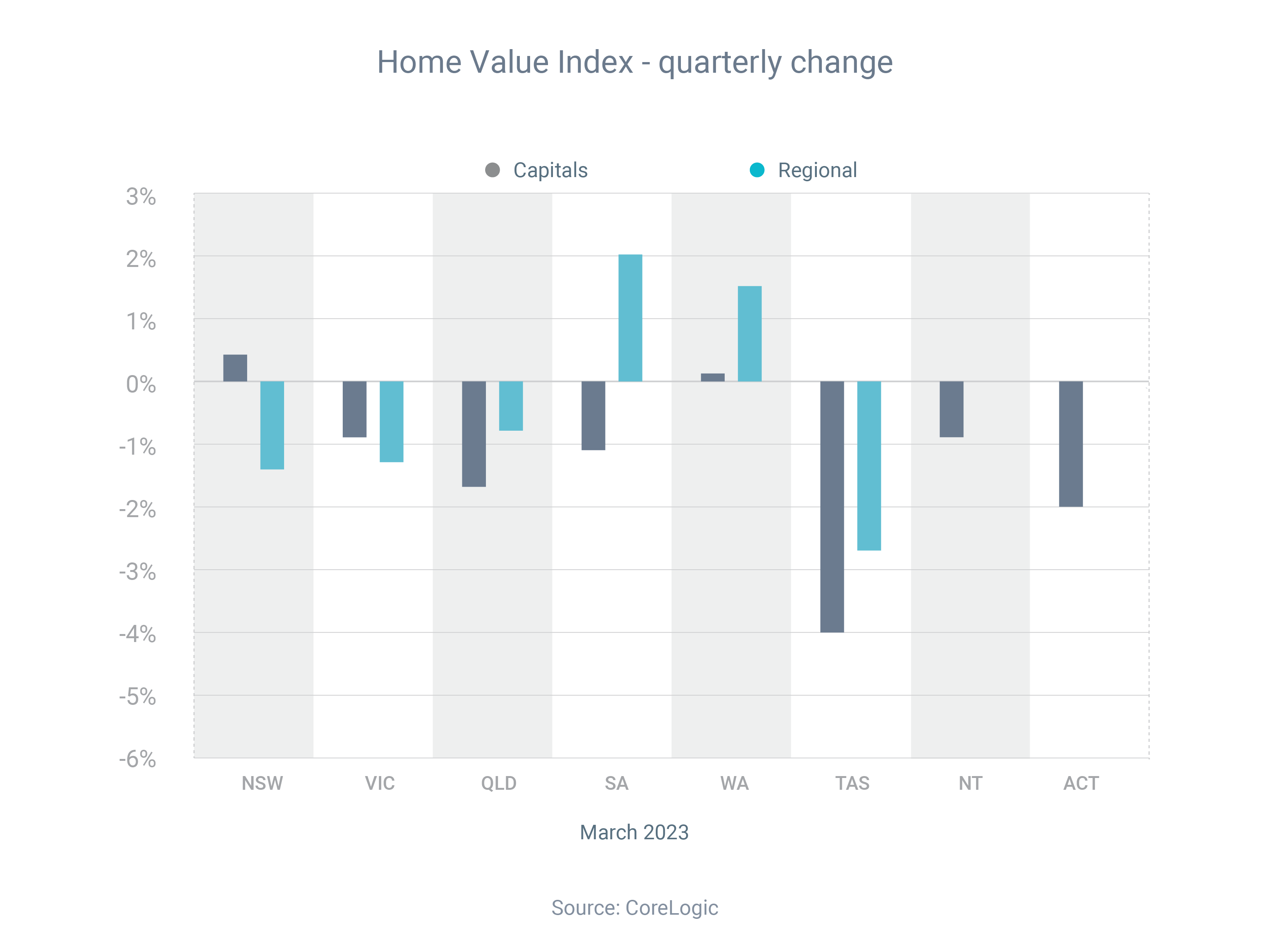

But while prices increased at a national level, and in Sydney, Melbourne, Perth and Brisbane as well, they did decline in the four smaller capitals.

Among the major capitals, Sydney saw the highest increase in property prices. Syndey shows a 1.0% increase, followed by Melbourne with an increase of 0.4%. However, the four smaller capitals shows a decline of the property prices.

Tim Lawless, Corelogic’s director outlined the reasons for property price increases.

- Tight rental market

- Scarce accommodation

- Rising rents which motivates some tenants to switch from renting to buying, thereby increasing buyer demand

- Migrants skipping the rental phase and fast track a home purchase

Although there are still some obstacles to overcome, the outlook for Australian unit values is beginning to look more promising. This month may indicate a change in the direction of values. Since many fixed-rate loans are just now beginning to end and will revert to variable rate, it is debatable whether we have yet fully experienced the effects of interest rate increases. Nonetheless, three of Australia’s four major banks continue to predict that the cash rate will increase by another 25 basis points in the upcoming months.

Given that the property downturn may be over, it is absolutely worth that renters look into the property market now while the property rise has just started than later in year. We can discuss your current circumstances and objectives and assess your borrowing power by looking at your income, expenses and commitments. Contact us and we will be happy to run the numbers for you.