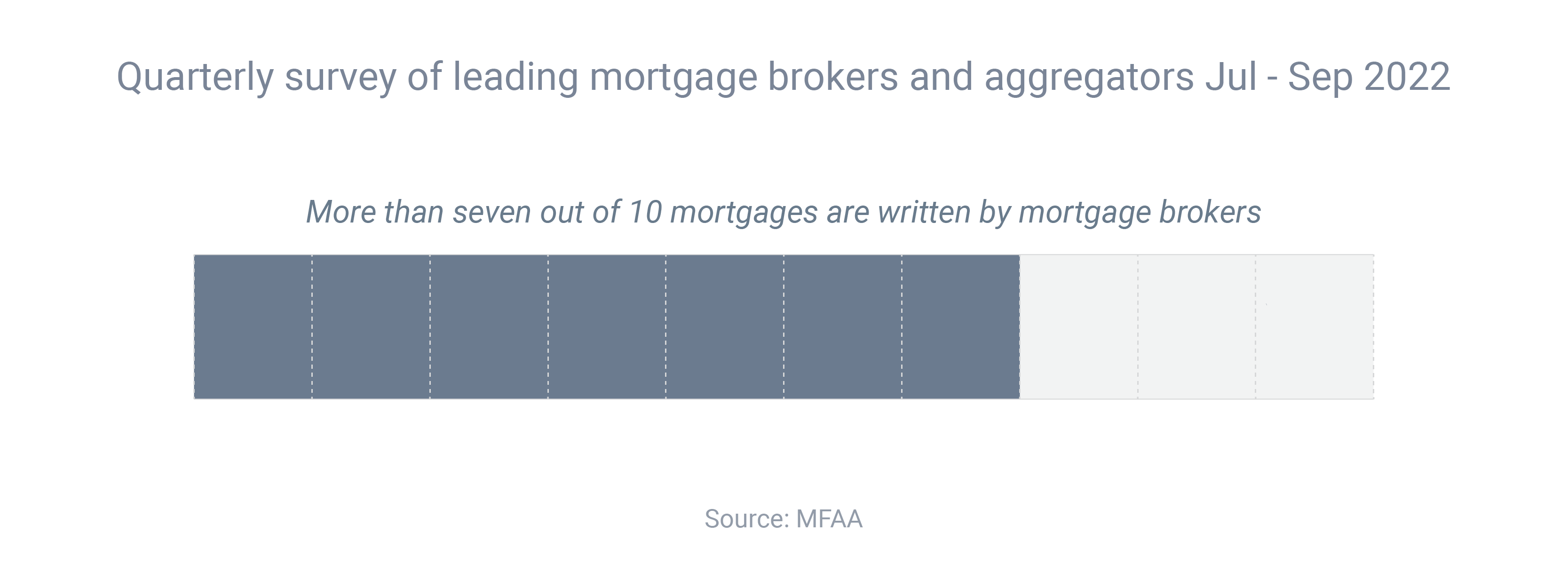

An ever-growing majority of homebuyers are taking out home loans using mortgage brokers, rather than going direct-to-lender.

Between July and September 2022, mortgage brokers facilitated 71.7% of all new residential home loans. This is a record share according to the research group Comparator.

That compared to 66.9% the year before and 60.1% the year before that.

Anja Pannek, the chief executive of the Mortgage & Finance Association of Australia, which commissioned the research, said the result highlighted the trust and confidence that consumers have in mortgage brokers.

“Mortgage brokers are well placed to support their clients to understand their options and select the product best suited to them,” she said.

Based on the research, there are four reasons why a majority of homebuyers are now using mortgage brokers:

- Mortgage brokers are flexible when it comes to meeting with homebuyers. Appointments can be done via video conferencing or during weekends to suit the availability of the homebuyers. These are highly favorable to full-time workers who have limited time during working hours.

- Mortgage brokers have access to a broad panel of lenders .They can match the lenders’ loan products against the borrower’s requirements, objectives, current circumstances, and borrowing capacity.

- Mortgage brokers provide expert advice and will walk the borrowers through the pros and cons of the options provided. They guide home buyers to make a sound decision.

- Mortgage brokers can negotiate a more competitive rate with the home buyers’ current lender or refinance to a different product.

So, if you’ve been thinking about seeking a home loan, please contact us. We offer a no obligation consultation and we are confident you will be better off for having dealt with us. No matter what your circumstances are, we can actively assist you in navigating your current situation.