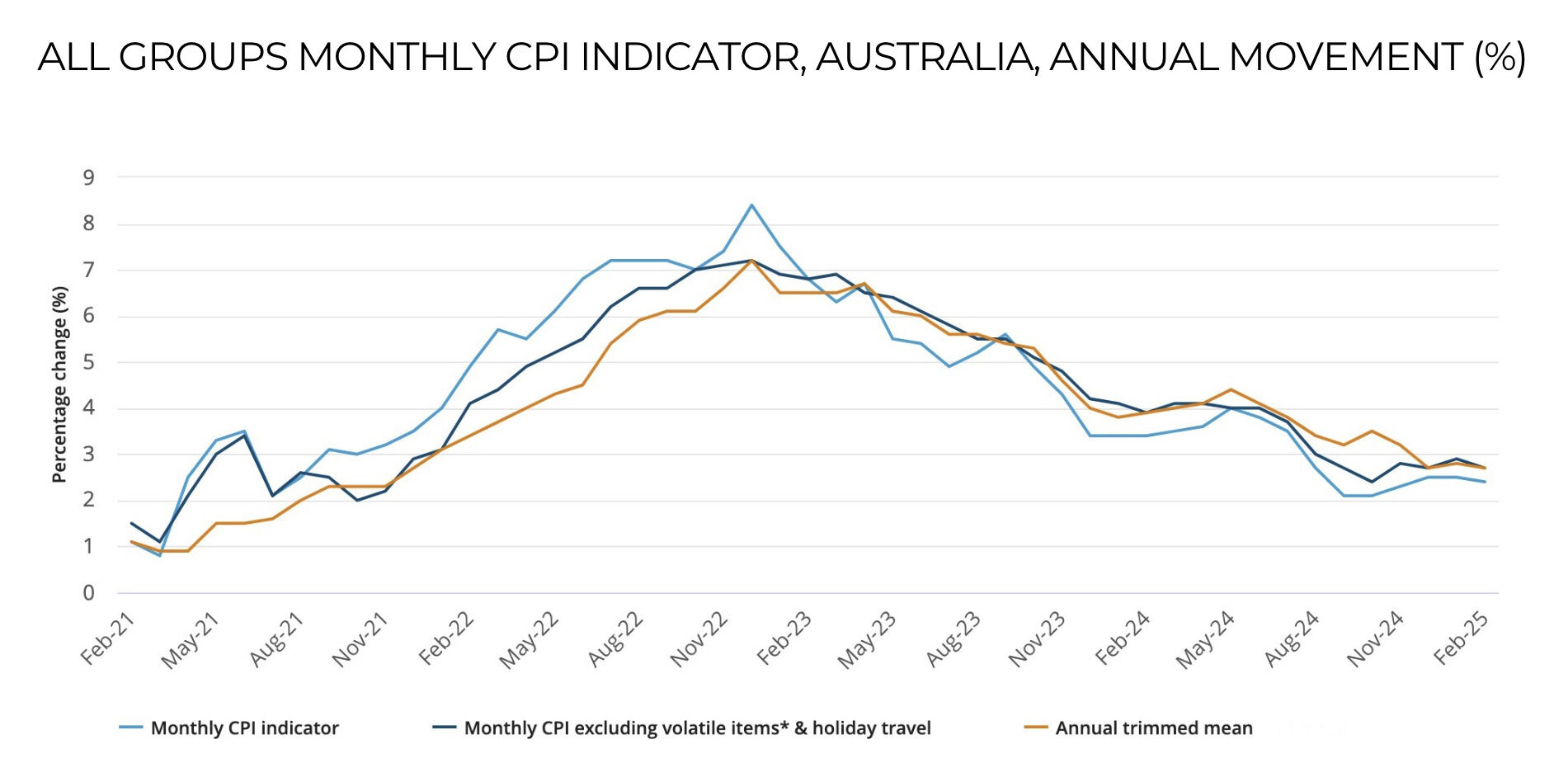

The latest inflation data, recorded before the USA announced its recent series of tariffs, show that inflation continues to ease, increasing the likelihood of future interest rate cuts.

The Australian Bureau of Statistics reported that the annual headline inflation rate declined from 2.5% in January to 2.4% in February, marking the seventh consecutive month it remained within the Reserve Bank of Australia’s (RBA) target range of 2–3%.

Similarly, the annual trimmed mean inflation rate—which the RBA considers more reliable due to its exclusion of items with extreme price volatility—fell from 2.8% in January to 2.7% in February, the third consecutive month it stayed within the target range.

Over the past three years, the RBA has actively kept interest rates high to reduce economic demand and apply downward pressure on inflation

If the RBA believes it has inflation under control, it may reduce the cash rate at its next monetary policy meeting in May, which could prompt lenders to lower their mortgage rates. That said, the RBA might give even more weight to the global instability caused by the tariff issue when deciding whether to adjust the cash rate.

Thinking about buying your first home or adding an investment property to your portfolio? There’s no better time than now to take the next step. Contact us to explore your loan options, get expert advice, and secure a competitive home loan that fits your goals.