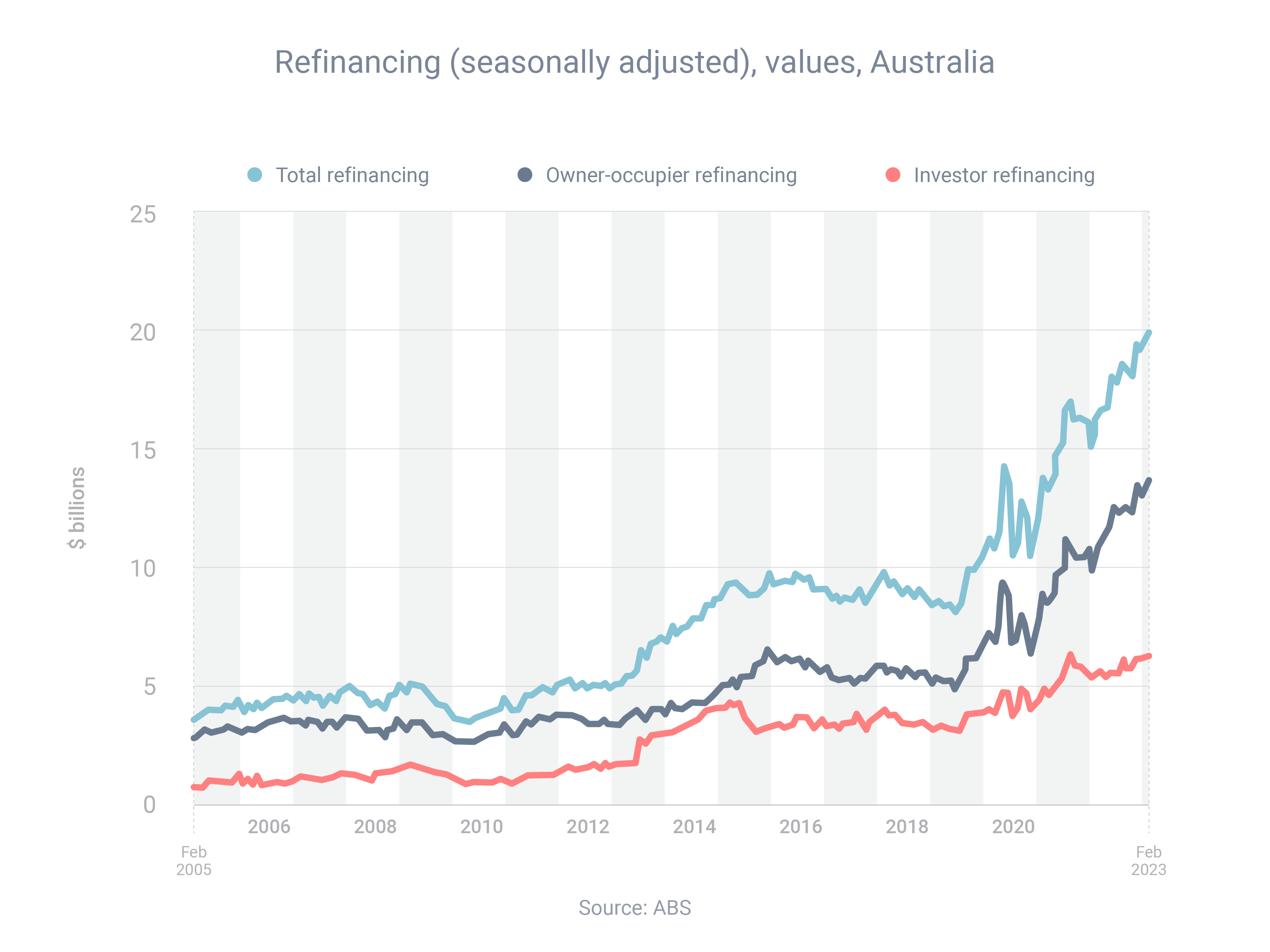

The home loan refinancing boom, which has lasted for two years and counting, surged to record levels.

Refinancing activity has dramatically increased during that time from $13.7 billion worth in February 2021 to $16.2 billion in February 2022 and, now, according to the latest Australian Bureau of Statistics data, a record $19.9 billion in February 2023.

The refinancing surge started in 2021 when interest rates were at record-low levels – at that point, many borrowers refinanced so they could lock in ultra-low fixed rates.

The surge was given fresh life in May 2022 when the Reserve Bank started raising rates – many borrowers then refinanced to lower-rate loans to ‘cancel out’ rate rises.

A previous blog post outlined the reasons why borrowers are refinancing:

- They want to take advantage of the lower interest rates that lenders charge to new borrowers compared to loyal customers. By doing so, borrowers can potentially save tens of thousands of dollars over the life of their loan.

- They want to access their home equity via a cash-out and use these funds to grow their investment portfolio such as buying shares. They can also use the cash-out for home repairs and non-structural renovation.

However, it is worth taking into consideration the costs related to refinancing your current home loan. Additional Fees such as Lender Mortgage Insurance will be an additional cost if your home equity is less than 20%.

Due to home loan refinancing has surged, there’s no doubt the mortgage market has changed a lot in a short amount of time. So if it’s been at least two years since you refinanced, there’s a good chance your interest rate is unnecessarily high. Contact us to book an appointment so we can review your loan and see if there’s a better deal elsewhere.