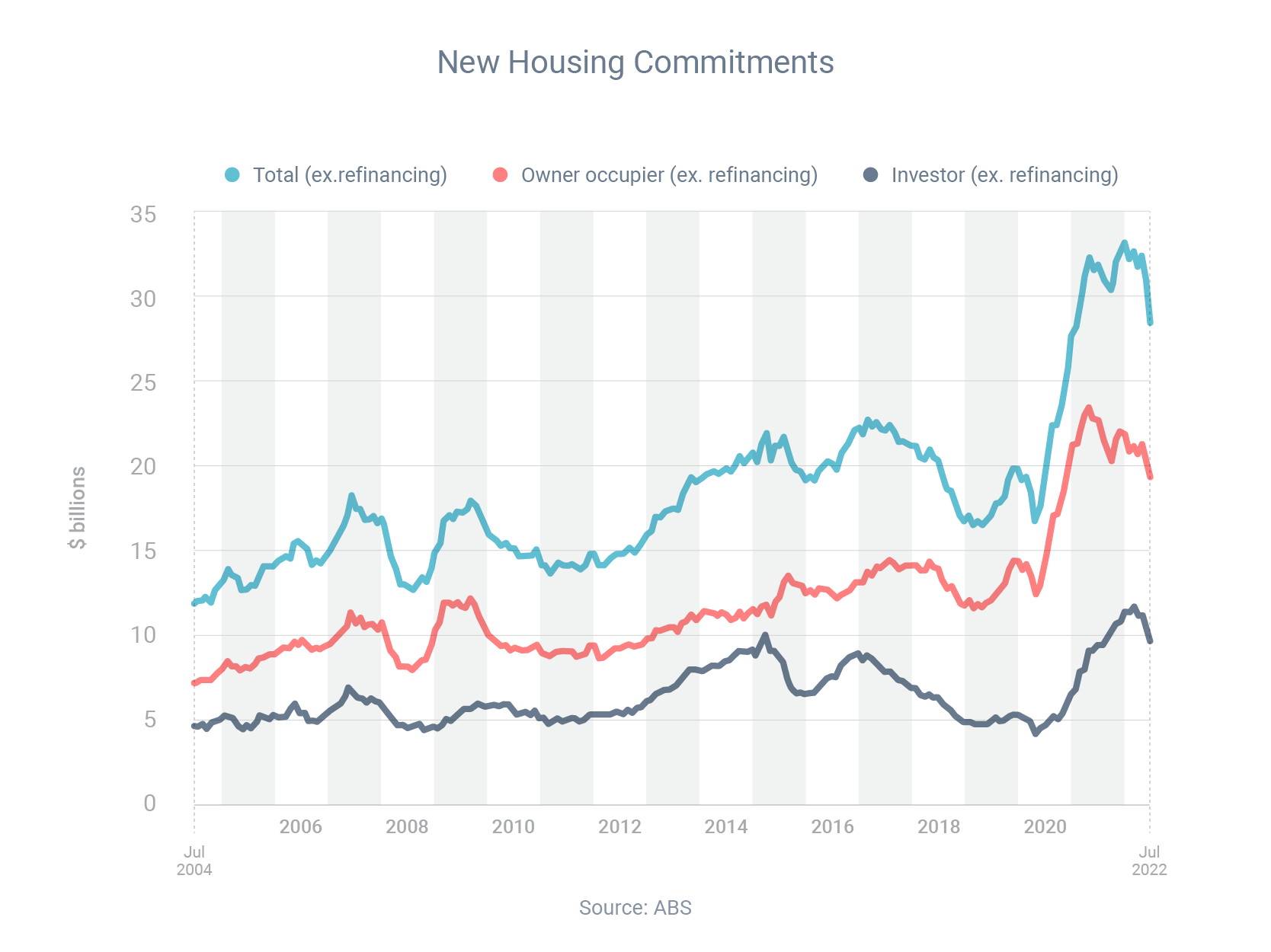

Buyers still remain active in the property market, judging by the latest home loans data from the Australian Bureau of Statistics.

Borrowers signed up for $28.4 billion of new home loans in July. That was 11.3% lower than the previous year but 47.3% higher than the average over the previous 15 years.

So while conditions are much more buyer-friendly than they were during the recent property boom due to a growing number of properties for sale in many parts of Australia, there’s still quite a bit of buyer competition, especially for quality homes.

While buyers remain active, refinancing is close to record-high levels.

Borrowers refinanced $17.9 billion of home loans through new lenders in July – which was not only 7.6% higher than the year before but also the second-biggest refinancing month in history.

With interest rates rising, many people realize how important it is to be on a lower-rate loan, so they’re shopping around.

If you are thinking about assessing your finances to know if refinancing your current home or buying your own home is perfect for your current situation, Australian Loans Group can actively assist you in navigating your current situation. We offer no obligation consultations and we are confident you will be better off for having dealt with us.

Get in touch via our online contact form or simply give us a call on 03 8589 8952.