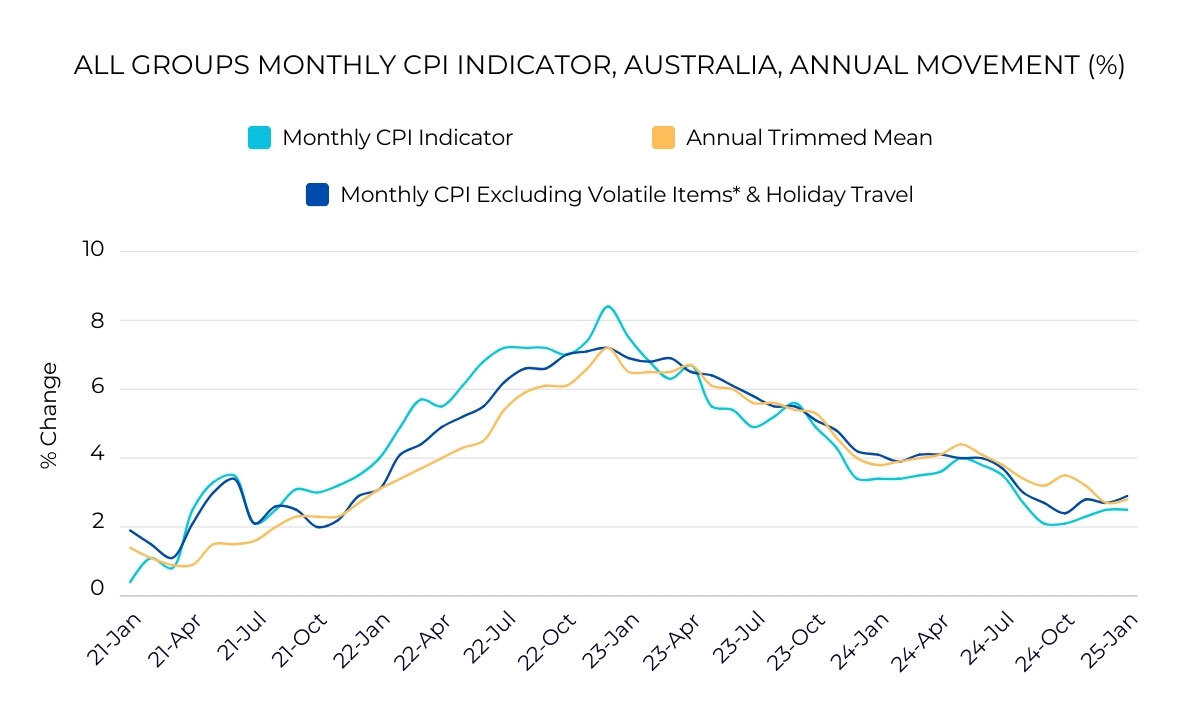

The national inflation rate in January was a moderate 2.5% but prices are changing at different rates and are affecting different parts of the economy, according to the Australian Bureau of Statistics.

On the high side, prices increased by 6.5% year-on-year for education, 6.4% for alcohol & tobacco and 5.3% for insurance & financial services.

On the low side, prices rose only 0.9% for recreation & culture and 0.5% for transport, while falling 0.6% for communications.

As a result, businesses are having very different inflationary experiences right now, depending on the inputs they buy and the products/services they sell.

Meanwhile, the Reserve Bank of Australia (RBA) released the most recent Statement on Monetary Policy in February, noting that it expects underlying inflation to remain within the RBA’s target range of 2-3%. The statement also highlighted that the outlook for underlying inflation has changed. It now stands slightly higher than it was three months earlier.

The RBA said, “We assess that the pick-up in GDP growth will lead to tighter labour market conditions than we previously expected and will sustain some upward pressure on inflation. We assume that inflation expectations will remain consistent with achieving the inflation target over the long term.”

Clearly, inflation is affecting the economy, and it will continue to play a key role in shaping economic conditions moving forward.