Despite the interest rate rises that have occurred since last year, rates are lower than expected.

Despite the interest rate rises that have occurred since last year, rates are lower than expected.

The number one contributing factor to this is the “strong competition between lenders”, according to the Reserve Bank.

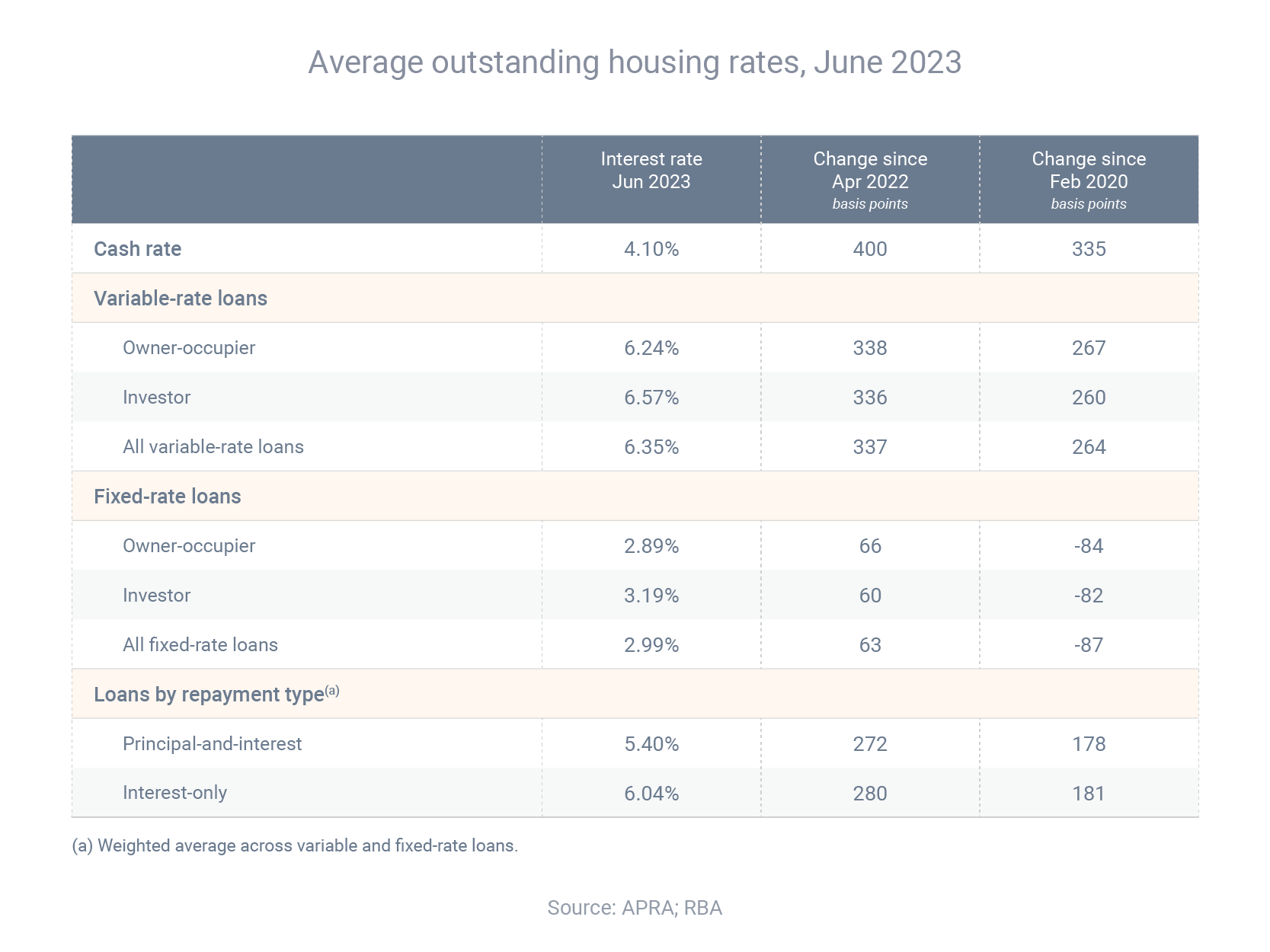

Between May 2022 and June 2023, the cash rate increased by 4.00 percentage points. But during that same period, the average interest rate for outstanding variable-rate loans increased by only 3.37 percentage points.

When all outstanding loans (variable and fixed) are taken into account, the average interest rate increased by 2.75 percentage points during the same period. That’s because some borrowers still have low-rate fixed loans that were issued before the rate hikes began.

According to the Reserve Bank, the rate reached a peak in the June quarter. The percentage of borrowers switching from fixed-rate mortgages to a variable rate is just under 5.5%. It will remain high for the rest of this year before declining in 2024.

“These expiries will see the average outstanding mortgage rate continue to increase as the effect of the rise in the cash rate since May 2022 flows through to a greater share of borrowers.”

If your fixed rate term is coming to an end, you might want to consider refinancing to get a better rate for your home loan. Contact us to book an appointment so we can review your loan.