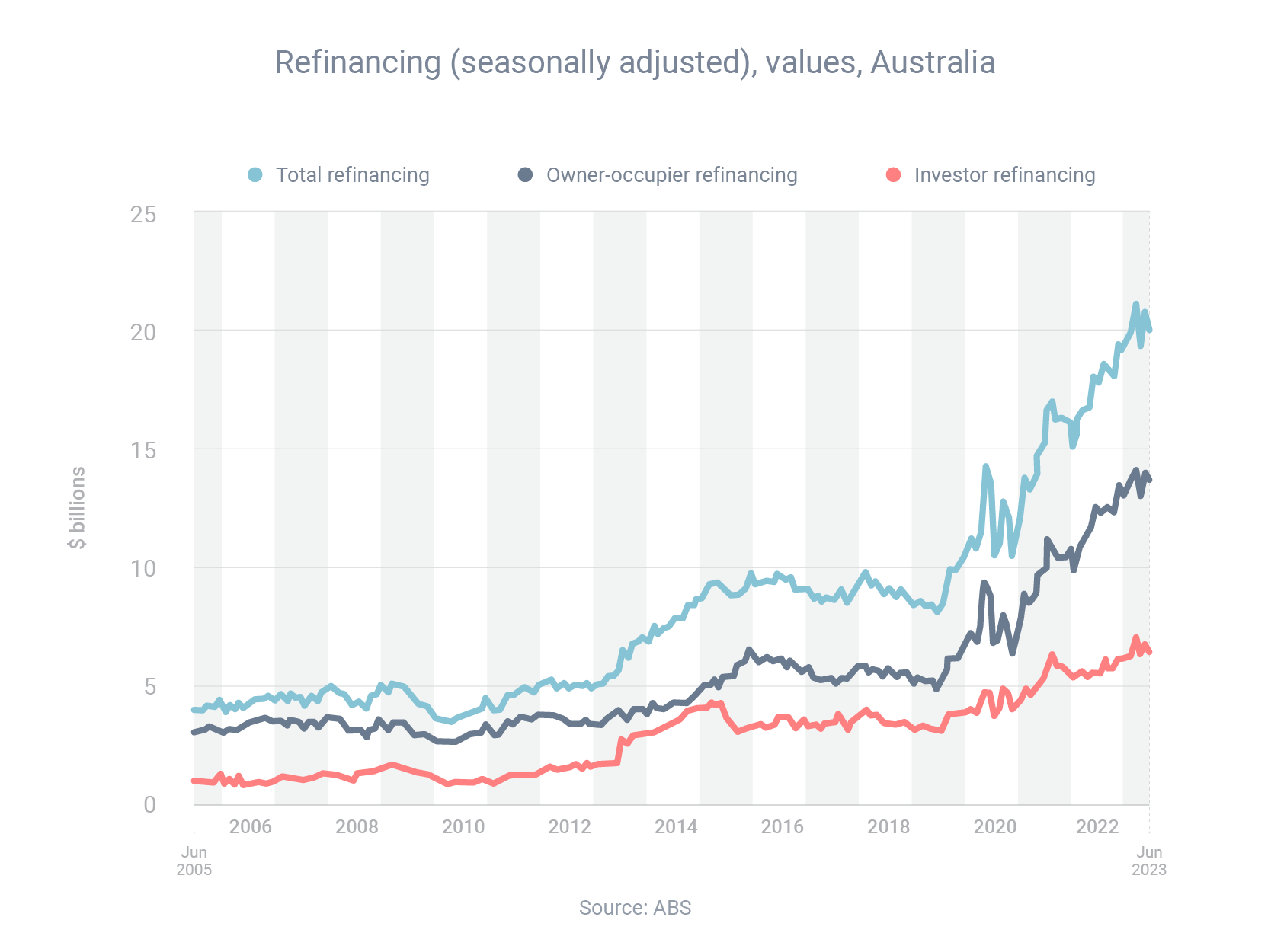

“Refinancing activity has remained at record highs in recent months, as borrowers continued to switch lenders amid interest rate rises,” according to the Australian Bureau of Statistics (ABS).

Owner-occupiers and investors refinanced a combined $20.2 billion of loans with external lenders in June, the ABS reported.

While that was 3.1% lower than the month before, it was 12.6% higher than the year before.

More significantly, the last 14 months have been the 14 biggest months in refinancing history.

This previous blog post looked into the reasons why borrowers are refinancing. These can be outlined two two factors:

- They want to take advantage of the lower interest rates that lenders charge to new borrowers compared to loyal customers. By doing so, borrowers can potentially save tens of thousands of dollars over the life of their loan.

- They want to access their home equity via a cash-out and use these funds to grow their investment portfolio such as buying shares. They can also use the cash-out for home repairs and non-structural renovation.

Unfortunately, interest rate rises are affecting a lot of households at the moment and is the main reason why refinancing remained at record highs. That’s why refinancing can be such a smart strategy.

If it has been at least two years since your loan approval, and you are seeking to refinance your home loan to a better interest rate, I can take a look at your existing loan and situation, compare the market, and potentially present some options that may save you money. Contact us to book an appointment.