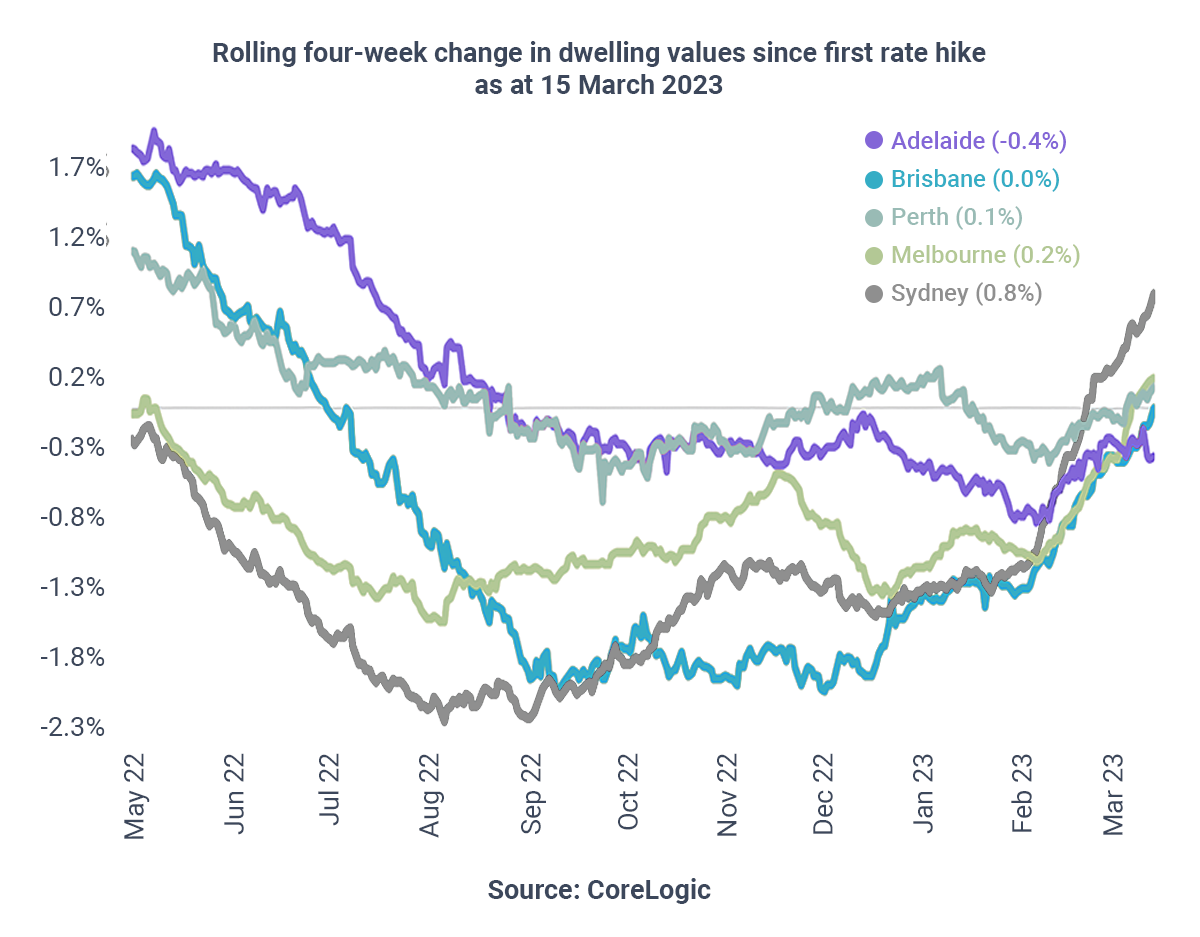

The housing slowdown may be nearing its end, according to new statistics from CoreLogic.

While Australia’s median property price fell 0.1% during February, values then rose in some markets in the four weeks to March 15:

- Sydney – up 0.8%

- Melbourne – up 0.2%

- Perth – up 0.1%

- Brisbane – unchanged

- Adelaide – down 0.4%

That said, it’s too early to call the bottom of the market even if data shows that housing slowdown may be nearing its end, according to CoreLogic’s executive research director, Tim Lawless.

“Interest rates may rise further from here, as well as the fact that we are yet to see the full impact on households from the aggressive rate hiking cycle to date,” he said.

“Additionally, economic conditions are set to weaken through the middle of the year, as household savings buffers are being depleted and labour markets are likely to loosen further.”

Mr Lawless said one of the key metrics to watch would be the flow of new property listings, as a relative increase in supply would lead to a relative decrease in demand, and “could be a signal this recent trend of growth has run out of steam”.

With that in mind, it is worth diving into the real estate market than later in the year as property prices are still set to rise and take advantage of the lower property prices. If you’d like more information, please contact us and we”ll be happy to discuss your plans.