There is good news for first-time home buyers as research from Domain shows that over the past year, it’s become significantly easier to save a 20% house deposit.

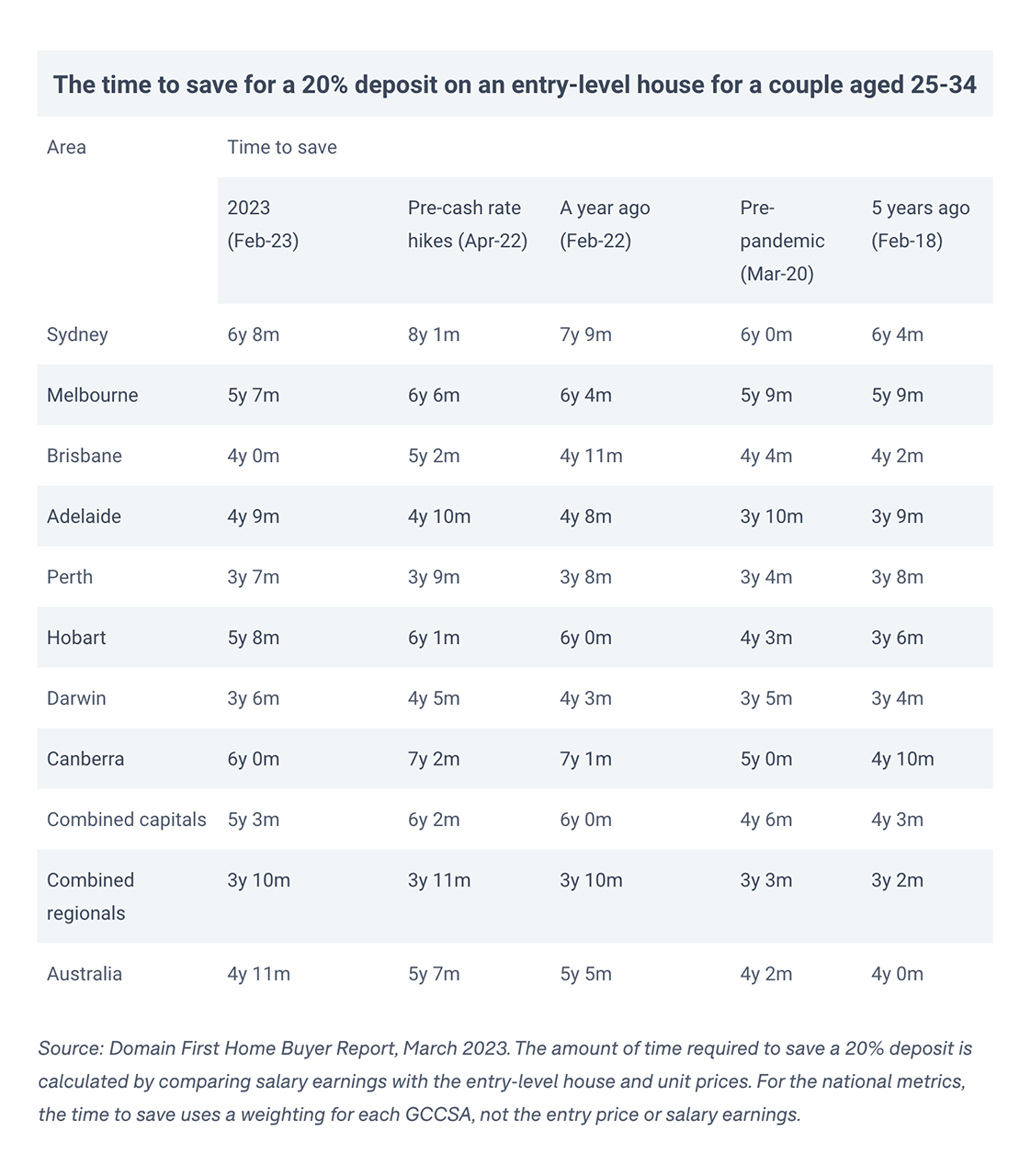

In order to become homeowners, first-time home buyers must overcome 2 significant financial obstacles. They need to save for a lump sum deposit and they need to keep up with the monthly mortgage repayments. February 2022 data shows that first home buyers needed an average of 5 years 5 months to save a 20% house deposit.

Saving for the 20% deposit is even more difficult due to the ongoing responsibilities such as record-high rent payments and rising living costs.

However, by February 2023, that had decreased to 4 years 11 months. It’s also become easier for first home buyers to save a 20% unit deposit, with the average time falling from 3 years 9 months to 3 years 7 months.

Domain calculated the average income and purchase price of first home buyers by assuming they were a couple aged between 25-34 years and were purchasing an entry-level property.

The quicker time to save for a 20% deposit can be attributed to 3 reasons:

- Falling property prices

- Wage growth

- Higher interest rates on savings

Additional good news for first-time home buyers is they can tap into Government Schemes such as the First Home Loan Deposit Scheme. This scheme enables first-time homebuyers to obtain a mortgage with as little as a 5% downpayment without having to pay an additional fee for the lender’s mortgage insurance. Tapping on to this scheme shortens the time it takes to save for an entry-level deposit by years, allowing access to the real estate market sooner.

With everything taken into account, it is highly recommended to start looking into buying your first home to take advantage of the lower property prices and avail of government grants such as the First Home Loan Deposit Scheme. Contact us and we’ll be happy to discuss your goals and objectives as well as assess your borrowing capability.