Rental market conditions have strongly favored property investors during 2022 as rental income rose significantly.

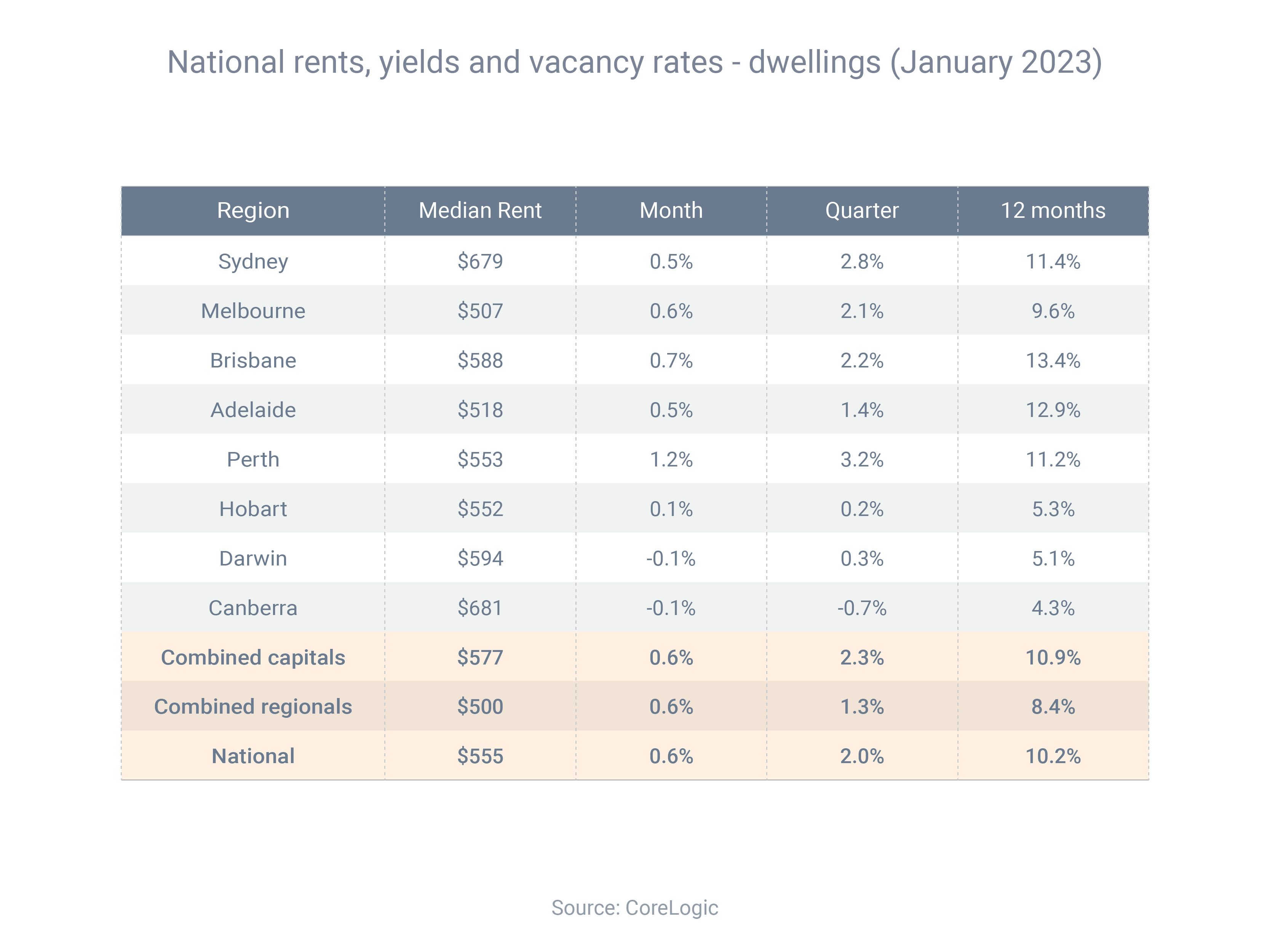

CoreLogic has reported that the median rent for an Australia investment property increased 10.2% during the year. The city-by-city breakdown was:

- Brisbane4%

- Adelaide9%

- Sydney4%

- Perth2%

- Melbourne6%

- Hobart3%

- Darwin1%

- Canberra3%

During 2022, the national vacancy rate fell from 2.1% to 1.2%. To put it another way, the number of untenanted rental properties fell from 21 per 1000 to a very low 12. That forced tenants to compete harder, pushing up rents.

According to a previous blog post, rental income rose during 2022 as a result of a significant increase in migrants and foreign student numbers. That means, demand is rising while housing availability is tight.

“Rents are still rising in most capital cities and regional areas, with vacancy rates low,” according to CoreLogic head of research Eliza Owen.

Between September 2020 (when this period of rental increases began) and December 2022, Australian rental rates increased 22.2% – the largest increase in a 27-month period in recorded history.

With rents likely to continue to rise, it is worth considering investing in rental properties. Contact us and we’ll be happy to discuss your goals and objectives.