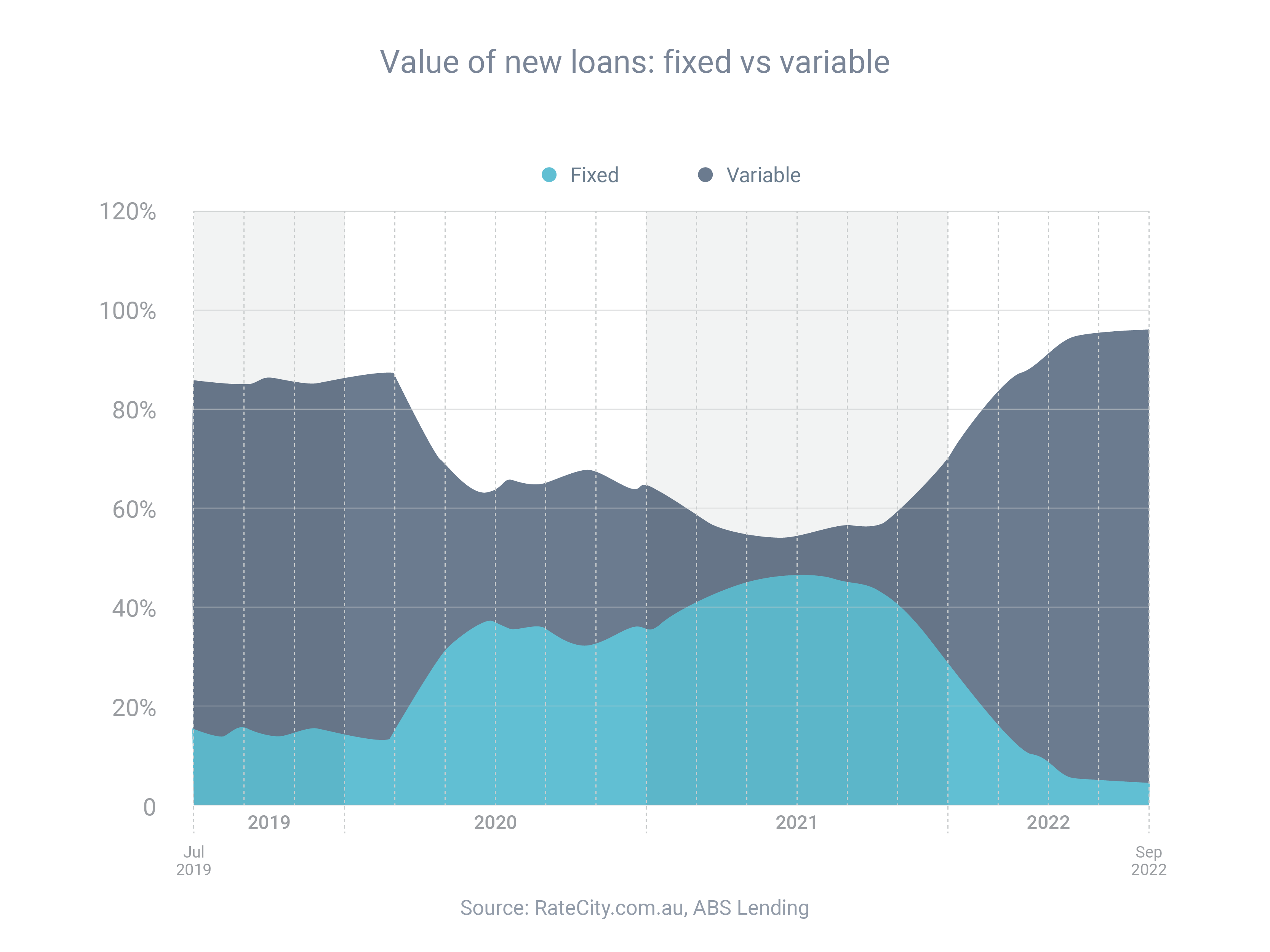

Borrowers favour the lower-rate variable loans right now. According to the October 22 data from Australian Bureau of Statistics, only 4% of borrowers fixed their loans (both new loans and refinances).

Very few borrowers are currently fixing their home loans – unlike a year earlier when about half of borrowers were doing so.

By contrast, 44% of borrowers fixed in October 2021 and 46% in August 2021 (when fixing peaked).

The Reserve Bank only started increasing the cash rate in May 2022. Lenders knew it was coming, so they’d already started raising interest rates on their fixed-rate loans. In response, borrowers had begun to favour the lower-rate variable loans.

This is confirmed by Reserve Bank data on new owner-occupied loans.

In October 2021, the average interest rate on a new fixed loan (with a fixed period of three years or less) was 0.63 percentage points lower than a new variable loan.

By February 2022, new fixed loans had become 0.09 percentage points dearer; by May they’d become 0.70 percentage points dearer.

That has since declined – by October, they were only 0.30 percentage points dearer.

If you are seeking a home loan and need guidance on whether a fixed or variable rate will be beneficial for you in the long run in terms of accumulated savings. , contact us and we will run the numbers for you.