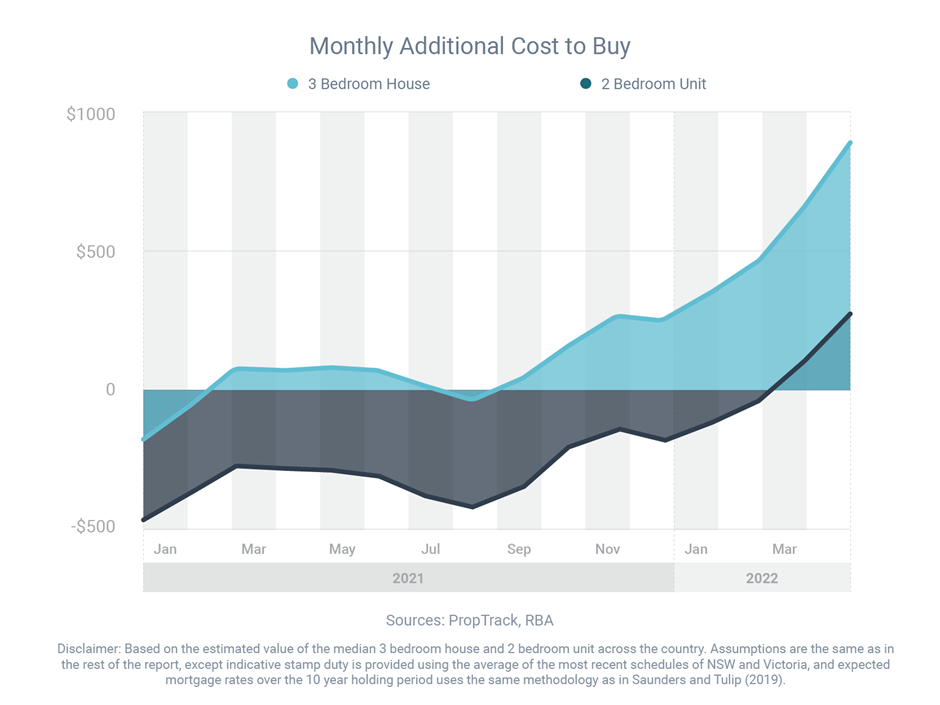

If you’re wondering whether it’s cheaper to buy or rent, a new report has answered that question. Now, bear in mind that interest rates are obviously on the way up at the moment, and that these figures are changing rapidly. However, it’s not all doom and gloom out there. Even with slightly higher interest rates, there are properties that make good sense when comparing to the cost of renting.

It’s currently cheaper to buy 27% of homes in Australia, according to PropTrack, although the numbers vary significantly from state to state:

- Northern Territory = 98% of homes are cheaper to buy than rent

- Western Australia = 62%

- Queensland = 51%

- Tasmania = 41%

- South Australia = 34%

- ACT = 29%

- New South Wales = 9%

- Victoria = 7%

PropTrack’s analysis relied on a range of assumptions, including that buyers would pay stamp duty, put up a 20% deposit, pay a mortgage rate of 4.62%, experience capital growth of 3% per annum and hold the property for 10 years.

While PropTrack found 27% of the overall housing stock is cheaper to buy than rent, buying turned out to be the cheaper option for 31.2% of three-bedroom houses and 52.6% of two-bedroom units.

They have also reported on their Property Listing for June 2022 that the activity in property markets rebounded in May. This means there is an increase of new property listings in Capital cities giving home buyers more chances of finding properties that are within their budget and within their preferred location.

With vacancy rate just at 1.0% in June, rents tend to rise. This has also become a driving factor why buying your own home is the cheaper option.

Wondering whether renting or buying would be cheaper for your personal scenario? If so, contact us and We’ll be happy to crunch the numbers for you.